Rent A Room Relief 2017 18 Hmrc

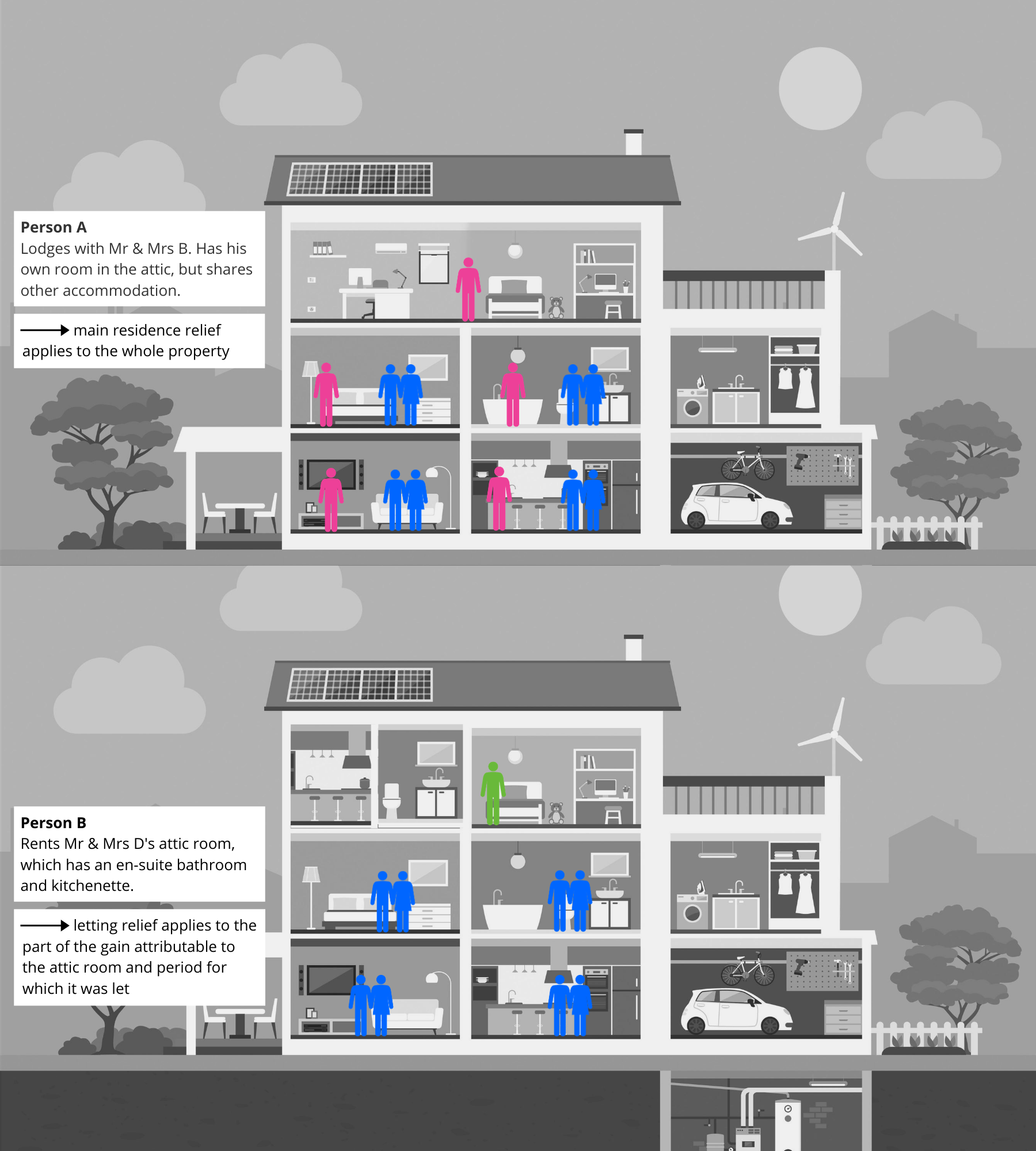

The rules of rent a room relief.

Rent a room relief 2017 18 hmrc. The helpsheet has been added for the tax year 2016 to 2017. The rent a room scheme lets you earn up to a threshold of 7 500 per year tax free from letting out furnished accommodation in your home. Rent a room relief was. Property rental toolkit 2017 18 self assessment tax returns published september 2018.

Rent a room provides a tax free limit of 7 500 per annum for people letting accommodation in their own homes. Claiming rent a room relief vs paying tax on your rental profits. Rent a room relief gives an exemption from income tax on profits of up to 7 500 to individuals who let furnished accommodation in their only or main residence. This is halved if you share the income with your partner.

Hmrc would like to hear about your experience of using the toolkits to help develop and. Unless you tell hmrc otherwise it assumes you are going to opt for method a and your rental income will be taxed under the normal rules. What if my rent a room income exceeds 7 500 for any one tax year. For the tax year 2016 to 2017 the annual rent a room limit is 7 500.

Take 7 500 tax free 3 750 if you re one of a couple and then pay income tax on any excess rent. If you meet all of the conditions for rent a room relief above but your gross property income exceeds 7 500 for 2020 21 also 7 500 for 2019 20 you do not qualify for the automatic exemption. However you can make an election to be taxed on an alternative basis. Effective from 6 april 2018 2.

2016 to 2017 rent a room limit has been updated. It applies automatically and does not have to be claimed. If there is more than one recipient of the income each person gets relief up to 3 750. The 2017 to 2018 helpsheet has been added to this page.

The rent a room scheme is aimed at individuals who let furnished living accommodation in. There are some changes coming to the rules for rent a room relief in 2019.